Development of E-sports industry in China: Current situation, Trend and research hotspot

by Yang Yue, Wang Rui*, Samantha Chiang Siu LingEmail: wangrui@njau.edu.cn

Received: 18 Aug 2020 / Published: 26 Nov 2020

Abstract

China has become the world's largest E-sports market, with a unique e-sports industry development model. This paper analyzes the current situation of China's e-sports industry from the dimensions of scale, structure and employment, and classifies the activities of e-sports industry. With the support of local industrial policies, China's e-sports industry will speed up the combination of offline and urban traditional industries; with the comprehensive promotion and application of 5g technology, China's e-sports industry will usher in a new round of industrial explosion cycle. At the same time, the next research focus of e-sports industry will focus on e-sports game standards, 5g E-sports mode, E-sports sports professionalized, E-sports education and E-sports culture

Highlights

- China's esports industry is significant

- Key policies made by the Chinese Government has enabled further expansion of the sector

- Areas of further research such as technology, player health and education are critical to sustainable growth.

Introduction

Whether esports are sports events has always been widely disputed in academia: Hilvoorde (2016) believes that esports lacks directly visible physical interactions [1] whereas others find that it has yet to develop physical training and a stable institution [2]. Esports is more included in the wider field of electronic games for research purposes [3]. However, esports, as a sport, has always been a research topic for Chinese sports scholars since China’s General Administration of Sports included esports as an official sport in 2003. We find esports to be an evolution of human sports behavior in the information age. A competitive sports activity takes the content of an electronic game as the carrier and utilizes technology to make competition between people possible [4].

China is number one in video game revenues and esports tournament viewership [5, 6]. The recognition of esports by the Chinese government and scholars has led China’s esports industry to take the same development path as professional sports from the beginning. Since the No. 93 document issued by the State Council of China in 2018, the esports industry has been clearly established as a new form of sports consumption. By the end of 2019, central and local governments of China have issued and implemented 98 normative documents as policy support of the esports industry. According to the level of legislation and normative content it is divided into three dimensions: comprehensive documents at the central level (10 in total), comprehensive documents at the local level (75 in total), and special documents on esports at the local level (13 in total). The introduction of an industry policy for esports further boosts its development [7]. According to the report of Penguin Intelligence "global esports industry development report 2020", the number of esports users in China will exceed 400 million, accounting for one fifth of the global esports population with a value exceeding 102.8 billion yuan and confirming China’s position as the largest esports consumer market in the world [8].

At the time of writing, the development of China's esports industry has entered a critical period of integration of cities and the development of professional sports. With the cooperation and support of the local administrative departments, the author has made a survey on the development of the esports industry in major cities of China. Local industrial and commercial data are collected and classified according to the characteristics of the esports industry. It is hoped that through this collection process, it is possible to explore the development of the industry, the bottlenecks and research areas to direct China's esports community.

China's esports industry

The esports industry can be seen as a derivative of the online video games industry which continues to expand. In recent years, with the popularization of mobile esports games, esports traffic has seen explosive growth.

China's esports industry is rapidly developing (Figure 1) with an annual compound growth rate of 132.2%, reaching 102.8 billion yuan by 2019. At the same time, more young people are engaged in the esports industry. In 2019, a record-breaking 145,000 employees have entered esports related jobs in China, while the total number of jobs in China's esports industry is 450,000.

Figure 1 – The scale of the esports industry in China from 2014 to 2019. Adapted from the

National Bureau of statistics and the policy data from local government [9-27]

Figure 1 – The scale of the esports industry in China from 2014 to 2019. Adapted from the

National Bureau of statistics and the policy data from local government [9-27]

Currently, there are no laws or regulatory policies related to esports in China. However, most provinces in China have set up esports professional associations to organize and promote the registration of professional esports athletes and coaches though certification and training. According to the statistical feedback from esports associations in various provinces, there are more than 700 registered esports clubs in China, and the number of professional esports athletes has exceeded 6,000. Esports events are now often created by third-party companies leading to an additional professional league with a training system for youth.

Figure 2 – Revenue structure of China's esports industry in 2019 [28]

Figure 2 – Revenue structure of China's esports industry in 2019 [28]

Revenue from China's esports industry is predominantly obtained from games and live streaming (Figure 2). The lack of income in professional clubs could well explain the shift many players have made relatively early in their career towards media outlets for potentially more competitive salaries. This could also encourage bad practices and illegal activities in clubs such as participation in betting.

Esports industry classifications and statistical standard

In 2019, China’s central government proposed bringing esports into the scope of the sports industry which is likely to lead to further classifications as found below (Table 1).

| Industry classification | Industry form | Representative examples |

|---|---|---|

| 1. Esports organization and management activities | Administrative departments and trade associations | Information Center of General Administration of Sport of China |

| 2. Esports competition performance activities | Clubs and tournament organizers | TJ Sports EDG,OMG,LGD |

| 3. Other esports leisure activities | Internet cafes and hotels | WENTE esports hotel |

| 4. Esports venues and facilities management activities | Esports towns and arenas | Taicang Esports Town |

| 5. Esports brokerage and agency, advertising and exhibition, performance and design services | Advertising and exhibition service companies | VSPN |

| 6. Esports training and education services | Colleges, universities and vocational training institutions | Super-gen Education Investment Co.,Ltd. |

| 7. Esports live broadcasting service | Live streaming platforms | Huya, Douyu |

| 8. Esports information service | Software companies | Guangzhou Quwan Network Technology Co.,Ltd. |

| 9. Esports equipment production and sales service | Manufacturers and sellers of esports products | THUNDEROBOT |

| 10.Construction of esports venues | Architectural and engineering companies | HUATI GAMING |

China’s esports industry scale and structure

China’s esports industry scale

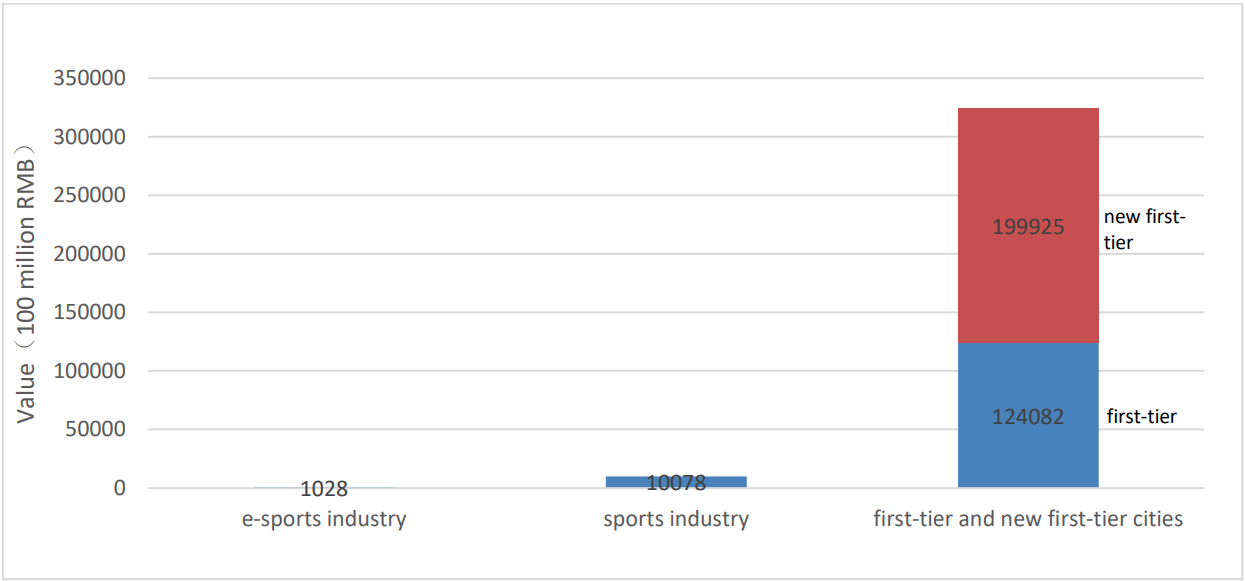

Based on the fact that the esports industry integrates with developed cities first, it is possible to create a comparison of China's esports industry based on the aforementioned value of 102.8 billion yuan in the context of the sports industry and full city economies within China according to first-tier cities and new first-tier cities (Figure 4). The so-called "first-tier" and "new" cities rank 338 cities at and above the prefecture level in China based on five indicators: concentration of business resources, urban hub, urban human activity, lifestyle diversity and future plasticity. The four first-tier cities include Beijing, Shanghai, Guangzhou and Shenzhen. The 15 new first-tier cities are Chengdu, Chongqing, Hangzhou, Wuhan, Xi'an, Tianjin, Suzhou, Nanjing, Zhengzhou, Changsha, Dongguan, Shenyang, Qingdao, Hefei and Foshan.

Figure 4 – Comparison of the value of China's esports industry compared with the sports industry

and China’s first-tier cities and new first-tier cities. Adapted from the National Bureau of

statistics and the policy data from local government [9-27].

Figure 4 – Comparison of the value of China's esports industry compared with the sports industry

and China’s first-tier cities and new first-tier cities. Adapted from the National Bureau of

statistics and the policy data from local government [9-27].

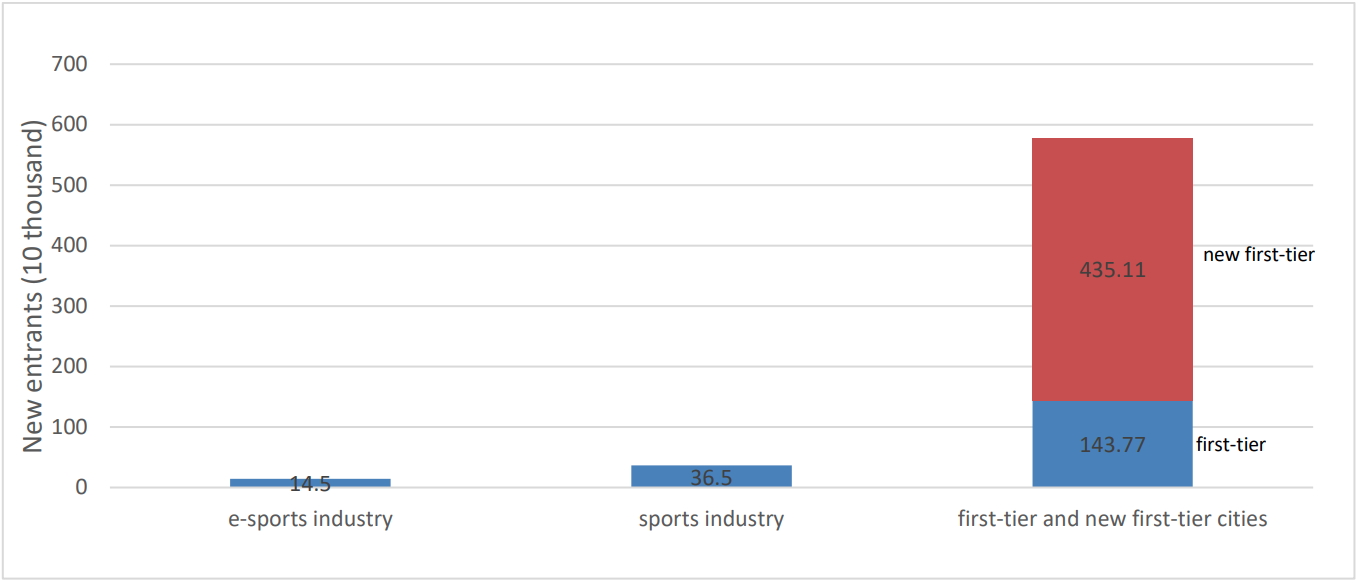

From the perspective of the output value of the national esports industry in 2019, the GDP created by China's esports industry accounted for 0.10% of the total national output value. In comparison, the sports industry of 1007.8 billion yuan accounted for 10.20% and it also accounted for 0.32% of the GDP in first-tier and new-tier cities [29] . From the perspective of the employment capacity of China's esports industry, the current employment capacity of the esports industry is 450,000. Out of these jobs, 145,000 of them will be created in 2019. It is thus possible to compare the number of new entrants in China's esports industry as opposed to the sports industry and the first-tier cities (Figure 5).

Figure 5 – Comparison of the number of new entrants in China's esports industry, sports

industry, China, First-tier cities and new first-tier cities. Adapted from the National Bureau of

statistics and the policy data from local government [9-27].

Figure 5 – Comparison of the number of new entrants in China's esports industry, sports

industry, China, First-tier cities and new first-tier cities. Adapted from the National Bureau of

statistics and the policy data from local government [9-27].

From the perspective of the output value of the national esports industry in 2019, the number of new entrants in China's esports industry accounts for 1.07% compared with 39.73% in the sports industry and 2.50% in the first-tier cities and new first-tier cities [9-27].

It is worth recognizing that the Chinese government has been promoting the equalization of sports and the importance of all types of fitness. The difference of public sports service resources between first-tier and second-tier cities and between cities and villages has been decreasing. The sports industry and the employment of sports industry are distributed evenly throughout the country. New job opportunities in the esports industry seem to be mainly linked to city growth, with our data suggesting that 2.7 out of every 100 new jobs related to the sports industry whereas the esports industry creates jobs for 2.12 people for every 100 people. Whilst the scale of the esports industry is smaller than that of the sports industry, its ability to create new jobs is comparable.

Policy support

The world esports industry appears to be shifting towards China in terms of the market revenue and viewing figures. Driven by the opening of broadcast platforms and the expansion of advertising sponsorships, the economic value of fans and the competition itself is likely to expand further. At present, esports has brought huge internet traffic and formed a fan-based economy. On the one hand, it can enable traditional businesses to carry out online sales while on the other hand it has formed some derivative industries such as esports game guessing and even gambling. With the development of the internet payment habits of the younger generation in China, membership subscriptions and value-added services are expected to be the main growth point of the industry.

Since 2014, China's esports market has maintained high growth and high attention. On the one hand, the Chinese society is gradually treating online games differently from esports. Conversely, the central government recognizes the role of the esports industry in promoting consumption and developing the national economy, while local governments are competing to introduce esports industry support policies. The specific performance is as follows: In 2018, the General Administration of Sport of China helped shape the national esports team that participated in the Jakarta Asian Games and won two gold medals and one silver. Esports has been recognized by local governments as the most active part of the cultural entrepreneurship industry.

Local governments have introduced support policies that promote the esports industry transitioning from online to offline. In 2018, the Shanghai government issued specific esports industry policies to explicitly subsidize the introduction of international level esports events and arenas. In 2019, Shanghai successfully hosted DOTA 2’s premier event, “The International 2019” and League of Legends Worlds Tournament in October 2020. Local governments of Shanghai, Guangzhou, Beijing, Chengdu, Xi'an and Hainan have also issued esports industrial policies in line with their own urban characteristics. In the foreseeable future, China's esports industry will move from online to offline, starting a new round of industrial expansion.

The current situation of China’s esports industry structure

As mentioned above, we divide the esports industry into ten major industry statistical subcategories based on the sports industry statistical classification standards issued by the National Bureau of Statistics of China. Through cooperation with local governments, we have obtained multi-dimensional data of industry, commerce, tax etc. of regional esports enterprises on the basis of signing confidentiality agreements. Based on the classification standard of industry statistics of the State Bureau of statistics, the China Esports Industry Database (CEID) is established. We obtained the industrial GDP and proportion of each branch of the esports industry (see Table 2 for details).

| Industry classification | Proportion of esports revenue | Employment ratio |

|---|---|---|

| 1. Esports organization and management activities | 0.47% | 1.53% |

| 2. Esports competition performance activities | 6.16% | 5.34% |

| 3. Other esports leisure activities | 0.02% | 0.20% |

| 4. Esports venues and facilities management activities | 0.01% | 1.83% |

| 5. Esports brokerage and agency, advertising and exhibition, performance and design services | 0.01% | 0.30% |

| 6. Esports training and education services | 0.50% | 1.04% |

| 7. Esports live broadcasting service | 8.68% | 1.40% |

| 8. Esports information service | 77.42% | 71.46% |

| 9. Esports equipment production and sales service | 6.72% | 10.62% |

| 10.Construction of esports venues | 0.02% | 0.40% |

| Total | 100% | 100% |

It can be observed in the table that some industrial classification activities of China's esports industry cannot obtain positive GDP. The main activity of esports industry are esports information services, which accounts for as high as 77.42% of GDP and is also the main activity to promote employment.

Key research areas for China’s esports industry

Research into standardization within esports

At present, China carries out approval and management at the national level for game releases with control of the scale and quantity by issuing the edition numbers. State regulators have yet to formally distinguish esports from online games. From the perspective of the long-term development of the esports industry, the technical standards of esports games need to be established urgently so as to be strictly defined and distinguished from the traditional online games. Esports is indeed poorly defined at an international level which hampers collaborative projects. Research into the classification of esports directly helps to define the category of esports and clear the technical obstacles for esports to be included in major events such as The Olympic Games.

Research on 5G technology and new mode of esports

5G has higher speed and reliability, supports more devices to connect with each other safely and quickly, and provides technical support for creating a brand-new three-dimensional digital environment [30]. By introducing more advanced and reliable technologies, it meets the demand of mobile traffic growth and solves the problem of 4G which cannot support the real-time transmission of ultra-high definition video with resolution of 2K or above. Additionally 5G brings development opportunities for VR (Virtual Reality) / AR (Augmented Reality) / MR (Mixed Reality), big data, artificial intelligence, smart wear and other large-scale commercialization in the sports industry [31]. We believe that the breakthrough of these technologies in the 5G era will directly affect the existence of esports as a sports event. According to Ernst & Young's report "China sets sail and leads the world's 5G" [32], China's capital expenditure on 5G will reach 1.5 trillion yuan (223 billion US dollars) from 2019 to 2025. In 2025, the number of 5G users in China will reach 576 million, accounting for more than 40% of the global total. This huge investment in the 5G network needs to be closely combined with the vertical industry to generate a large number of new applications and indirectly drive greater information consumption demand. Specifically, research is needed on network access standards with regards to 5G; body movement and motion sensing applications; the integration of 5G into esports globally, as well as the construction and development of gaming venues.

Research into the esports league and clubs

Unlike traditional professional sports, esports is a competitive sport based on online communities. There is a lack of long-term follow-up research on the economics and management theories on professional esports leagues and esports clubs despite work into communication and marketing theories for esports events and traditional sports [33]. Due to the lack of data, the internal operations of esports leagues and the levels of scale have not been tracked. The study of China's esports league is helpful to understand the evolution process of sports leagues. Although they are the core of esports professional events, esports clubs don’t have classic case studies at their disposal. The operation mode, management method, governance and supervision, investment and financing of esports professional clubs have not been studied enough as yet.

Research into esports injury and rehabilitation

Scientific training and rehabilitation of professional esports athletes are lacking in scientific literature. This is starting to be investigated in the West and it is expected that research in China will identify new patterns of behaviour and health in esports players [34]. For China's esports clubs, it is believed that the existing professional esports clubs have explored a set of training and management methods for professional esports athletes through their own practice. However, these regimes generally lack scientific input. It is necessary to explore the causes of esports injuries, identification methods, treatment methods and conditions for returning to esports. This will provide guidance for the prevention, treatment and recovery of sports injuries sustained by professional players and amateurs. Areas of expected study include scientific physical training plans, nutritional work, trialing treatment techniques and evaluating methods of sports injury.

Research on eliminating the negative effects of esports and esports education

To solve the problems of esports inherited from the games and entertainment industry (such as games addiction among teenagers) we need to prioritize industry regulation. China lacks the research on esports legislation and the rules of industry regulation which are in line with China's national conditions. In the long run, esports education plays an important role in social guidance. At present, esports education in China seems to develop from the community. The construction of esports’ higher vocational education and bachelor degree education system has not been completed and there is a lack of esports curriculum and textbooks that are generally accepted and recognized. The teaching faculty system is also in a state of exploration and construction.

Research on sustainable development and esports culture

The Olympic 2020 Agenda stipulates that Olympic host cities should include "sustainable development" in all aspects of Olympic construction, and sustainable development has become the long-term strategy of the Olympic family under the vision of the new round of reform [35]. The sustainable development of esports lies in the research of esports culture amongst the community, professional players and organizations. Further work is also required into the construction of arenas and use of materials. As the sector grows it is important that the gains made by the professionals are shared into the community to enable sustainable growth and opportunities across the entire Chinese population.

Conclusion

China's sports and esports industries have developed rapidly. As the world's largest esports consumer market, China has formed an esports industry that is becoming a significant area of revenue and employment for the nation. This is particularly important as it has captured a younger demographic which may well provide sustained employment during the growth of the sector. We expect China's esports industry to enter a new round of expansion and structural upgrade through governmental level policy support and the application of new technologies. To this end, further research will be essential to ensure maximal benefits in the next evolution of China’s esports industry.

References

- Hilvoorde I, Pot N. Embodiment and fundamental motor skills in esports. Sport, Ethics and Philosophy. 2016:1-14.

- Schary DP, Wozniak T, Jenny SE, Morrow GS. Short- and long-term retention of challenge course outcomes: A classroom-based longitudinal study. Recreational Sports Journal. 2016;40(2):152-64.

- Taylor NT. Now you’re playing with audience power: The work of watching games. Critical Studies in Media Communication. 2016;33(4):293-307.

- Yue Y. Research on esports and esports industry in the new era Sports Science. 2018;38(4):8-21.

- Newzoo. Top 10 countries/markets by game revenues. 2020.

- Statista. Share of internet users who watch esports tournaments worldwide as of july 2019, by country 2019. Available from: https://www.statista.com/statistics/823214/viewingesports-tournaments-selected-countries/.

- Rui W, Yue Y. Policy research on expanding sports consumption in my country from the perspective of family Sports Science. 2020;40(1):42-50.

- Global e-sports industry development report. 2020.

- Scale of the national sports industry: General Administration of Sport of China; 2020. Available from: http://www.sport.gov.cn/n319/n4835/c942314/content.html.

- National data: National Bureau of Statistics; 2020. Available from: https://data.stats.gov.cn/.

- Government of china: Chinese Government; 2020. Available from: http://www.gov.cn/xinwen/2020-01/15/content_5469157.htm.

- Beijing municipal statistical communiqué on national economic and social development in 2019: The People's Government of Beijing Municipality; 2020. Available from: http://www.beijing.gov.cn/gongkai/shuju/tjgb/202003/t20200302_1838196.html.

- 2019 shanghai statistical communiqué on national economic and social development: Shanghai Bureau of Statistics 2020. Available from: http://tjj.sh.gov.cn/tjgb/20200329/05f0f4abb2d448a69e4517f6a6448819.html.

- Guangzhou statistical communiqué on national economic and social development in 2019: China Statistical Information Network; 2020. Available from: http://www.tjcn.org/tjgb/19gd/36245.html

- In 2019, the number of new jobs in shenzhen's urban areas exceeded 160,000: Chinanews.com; 2020. Available from: http://www.gd.chinanews.com/wap/2020/2020-01-17/406820.shtml.

- Statistical communiqué on the development of human resources and social security in chengdu in 2019: Chengdu Human Resources and Social Security Bureau; 2019. Available from: http://gk.chengdu.gov.cn/govInfo/detail.action?id=2681189&tn=11.

- 2019 statistical communiqué on the development of human resources and social security in chongqing: Chongqing Municipal People's Government Network; 2020. Available from: http://rlsbj.cq.gov.cn/zwxx_182/tzgg/202008/t20200818_7789774.html.

- 2019 statistical communiqué on hangzhou's national economic and social development: Hangzhou Government Portal, China; 2020. Available from: http://www.hangzhou.gov.cn/art/2020/3/20/art_805865_42336875.html.

- 2019 statistical communiqué on wuhan's national economic and social development: Wuhan Municipal Development and Reform Commission; 2020. Available from: http://fgw.wuhan.gov.cn/zwgk/jcxxgk/sjfb/whcpi/202007/t20200720_1406531.html.

- Xi'an statistical communiqué on national economic and social development in 2019: Xi'an Investment Cooperation Bureau 2020. Available from: http://xaic.xa.gov.cn/xxgk/gsgg/5e7c07cff99d650203f93167.html.

- 2019 tianjin national economic and social development statistical bulletin: Tianjin Bureau of Statistics; 2020. Available from: http://www.tj.gov.cn/sq/tjgb/202005/t20200520_2468078.html.

- Annual report: Shenyang Municipal People's Government 2020. Available from: http://www.shenyang.gov.cn/html/SY/154700103578095/154700103578095/null/0357809512684482.html.

- 2019 zhengzhou national economic and social development statistical bulletin: Zhengzhou Government; 2020. Available from: http://tjj.zhengzhou.gov.cn/tjgb/3112732.jhtml.

- Changsha city's 2019 national economic and social development statistical bulletin: Changa City Statistics Bureau; 2020. Available from: http://tjj.changsha.gov.cn/tjxx/tjsj/tjgb/202003/t20200318_7042166.html.

- Report on the implementation of dongguan's national economic and social development plan in 2019 and the draft plan for 2020: Dongguan Daily Digital Newspaper; 2020. Available from: https://epaper.timedg.com/html/2020-06/18/content_1618474.htm.

- 2019 qingdao national economic and social development statistical bulletin, the city's permanent population of 9.49 million: Qingdao News Net; 2020. Available from: https://baijiahao.baidu.com/s?id=1662273357300312614&wfr=spider&for=pc.

- Foshan statistical bulletin in 2019: The total gdp of 1,075.1 billion, the permanent population increased by 252,900: China Business Industry Research Institute 2020. Available from: https://m.askci.com/news/hongguan/20200403/1418181158848.shtml.

- Analysis of the development status and trend of china's e-sports industry in 2020: Forward The Economist; 2020. Available from: www.qianzhan.com/analyst/detail/220/200403-aeaaa6ea.html.

- 13.52 million new jobs in urban areas in 2019: Government of China; 2020. Available from: http://www.gov.cn/xinwen/2020-01/15/content_5469157.htm.

- Lewis JA. How 5g will shape innovation and security. 2018.

- You X, Zhang C, Tan X, Jin S, Wu H. Ai for 5g: Research directions and paradigms. Science China Information Sciences. 2018;62(2):21301.

- Ernst & young: China sets sail to lead the global 5g 2018. Available from: http://www.199it.com/archives/741454.html.

- Park S-H, Mahony DF, Kim Y, Kim YD. Curiosity generating advertisements and their impact on sport consumer behavior. Sport Management Review. 2015;18(3):359-69.

- DiFrancisco-Donoghue J, Werner WG, Douris PC, Zwibel H. Esports players, got muscle? Competitive video game players’ physical activity, body fat, bone mineral content, and muscle mass in comparison to matched controls. Journal of Sport and Health Science. 2020.

- Olympic agenda 2020: Official Website of the Chinese Olympic Committee; 2015. Available from: www.olympic.cn/e-magzine/1507/2015-07-20/2353198.html.